Links I would send you if I were your lawyer #2

Legal nuggets for Fintech, Crypto and other tech founders and builders

Hey founders et al. Every week I will be sending a list of links to relevant legal happenings related to Crypto/Web3, Fintech and other founders and builders in tech. TGIF.

April 14, 2022

General News

The biggest news today has to be Elon Musk’s bid to buy Twitter and take it private.

But how does this actually work? What we have here is a classic hostile takeover attempt. Read here for a good overview of what that means. Just replace “acquiring company” with “Elon Musk” because, well, he’s that rich. TechCrunch also published a helpful article about hostile takeovers in response to this crazy news.

Fintech

Putting another D in UDAAP. The CFPB will now target discrimination as an unfair practice in connection with all financial products and services, not just credit products. This change in philosophy represents a large shift in the CFPB's stance on what constitutes a UDAAP (Unfair Deceptive and Abusive Acts and Practices) violation, formalizing discrimination as something they will enforce outside of misbehaving creditors subject to ECOA. Practically speaking… this means that all financial services businesses need to get a grip on what their demographics data shows.

Credit reports sans medical debt. The major credit bureaus (you know them as Equifax, TransUnion, and Experian) are planning changes that are actually good for consumers. The proposed changes would eliminate as much as 70% of medical debt information currently reported to the bureaus. According to this detailed report, medical debt collections activity appears on some 43 million Americans’ credit reports.

CFPB goes after TransUnion. Despite the good news above, CFBP Director Rohit Chopra still hates credit bureaus. The CFPB is now suing TransUnion for allegedly continuing to employ deceptive sales and marketing tactics. “TransUnion is an out-of-control repeat offender that believes it is above the law," CFPB’s Chopra said. Specifically, TransUnion used "dark patterns" — or hidden tricks — to get people to inadvertently click links to buy subscriptions, products or services, which are then difficult to cancel, the suit contends.

Buy now Pay never? BNPL company Afterpay has recorded huge half-year losses after a surge in bad debts and other operating costs failed to offset a big increase in the group’s revenue. What is the inherent quality of the asset class? The post pandemic period will be telling for both BNPL as an asset class and a business model.

Old news now but worth mentioning. Fast reportedly was spending around $10 MILLION PER MONTH, mostly on payroll, while bringing in just $50,000 per month in revenue. For a "fintech” company, they surely didn’t have a grasp on their own finances. Insane stuff.

Web3 / Crypto

“Please tell me us you’re doing any of that weird crypto stuff”. In a move stolen from your parents, the FDIC wrote to the banks it supervises asking them to notify it if they intend to engage in crypto activities. Copy of letter here.

Don’t quote me, quote us. In the ongoing Ripple case, a New York judge denied the US SEC’s motion to re-classify a 2018 speech by a former director as the agency’s policy (rather than the director’s personal views) in an attempt to make it privileged. In the speech, the director said bitcoin and ether were not securities. Some interesting stuff in here about the “deliberate process privilege” which I am re-learning now as I read the ruling.

Welcome to the club! The US New York State Senate authorized the DFS (Department of Financial Services) to collect supervisory costs from licensed virtual currency businesses it oversees. This is in line with the fees it charges the banking and insurance companies it monitors. An anonymous Crypto spokesperson said they’re honored to be included.

Around the world:

Stablecoins in Africa. Cameroon, the DRC and the Republic of Congo are in talks with the TON Foundation to launch stablecoins. Separate from CBDCs, the stablecoins would target retail payment transactions and potentially integrate with Telegram.

Central Bank Digital Currency (CBDC) in Japan? Bank of Japan won’t be issuing a CBDC with the aim of achieving negative interest rates. People have been talking about this as a way to assist in reversing negative interest rates. Japan is still testing the potential for CBDCs and will leave the ultimate decision “to the public”.

Brazil’s Senate passed a crypto bill which is expected to be approved in the first half of this year. The bill would give the President authority to designate a federal authority to draft new rules for the crypto industry, among other things.

India’s tax crushes crpto transaction volume. In the 10 days after India’s 30% tax on crypto profits entered into effect (on April 1), WazirX, one of the largest exchanges, saw transaction volumes plummet by 72%.

China still hates crypto. China‘s banking, securities and internet finance associations barred their members from providing trading venues or financing for NFTs. In addition, NFTs cannot be priced or settled in crypto, and NFT issuers need to use real-name identification.

Helpful resources

Two confusing topics, now combined! A good overview of (US) copyright considerations for NFTs.

Money Transmitter Laws + Crypo. Here’s a nice summary of money transmitter laws as they apply to the crypto space.

Wrap it up. Need to do “real life” things with your DAO? Check out Legal Nodes. They enable you to “wrap” your DAO into a legal entity (an LLC or similar entity depending on the country) so that it can transact with real people in the real world.

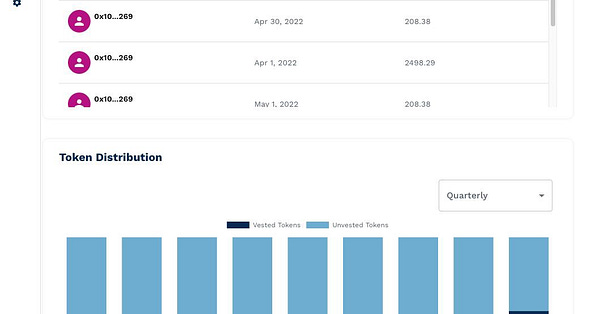

Working for Coins. Great twitter thread / article about using Tokens to compensate employees early on. Not legal advice… just sharing info!

That’s all for now. Stay lawyerly,

Brian